AerCap Deep Dive

This is a repost from a 2019 analysis. Most of the data and analysis is pre-covid, but I wanted to share it anyway. This analysis does not include the $34B deal by AerCap to acquire GECAS in 2021.

Executive Summary

COVID-19 has drastically impacted almost all businesses globally. One such affected area is air travel, which has come to a standstill (RPK down 90+% by March). Airlines are expected to consolidate in the next few years as many go out of business due to the pandemic. However, air traffic will resume and life will go back to normal at some point. Airlines in the future, however, will try to maintain more financial flexibility (less buybacks, have more cash on the balance sheet, less debt). Currently, airlines procure their aircraft by either purchasing the aircraft directly from the OEM (Boeing) or by leasing the aircraft from a lessor. Leasing is incredibly beneficial for airlines. This report analyzes the attractiveness of the aircraft leasing industry, some analysis on the largest lessor (AerCap), and includes an excerpt at the end on how/whether the pandemic will impact the industry as a whole.

Industry Analysis

What is Aircraft Leasing?

Aircraft Leasing is when a leasing company buys aircraft and leases them to airlines. It is effectively a spread business, where lessors acquire aircraft by issuing funds at a cost, and then lease the aircraft to airlines for monthly lease payment in return.

Industry Drivers and Forecast

Air Travel

One of the major drivers of aircraft leasing is demand for air travel. Air traffic growth has been very resilient over the past few decades, with a decline only happening in 3 years since 1970 (Figure). The real reason why this is the case is because the correlation between air traffic growth between different geographic regions is low, so if one region is facing economic issues, another region will likely make up for that decline.

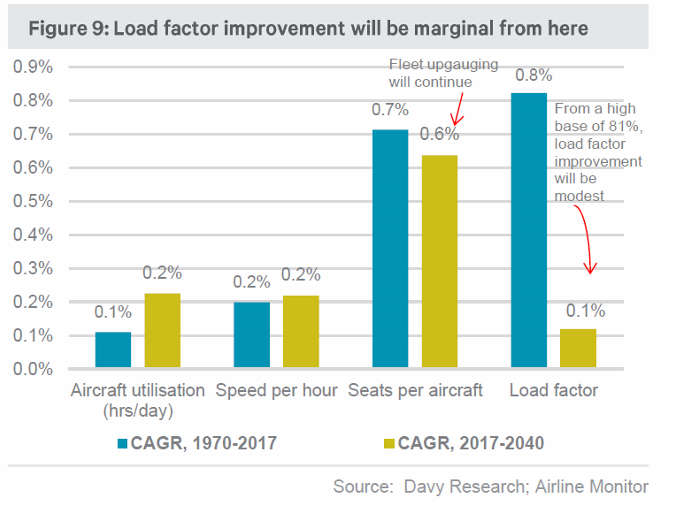

From 1970 to 2017, the major driver of the 6.1% air traffic growth was the growth in the aircraft fleet, and this will continue to be the case in the future. This is because there is little room to improve airline productivity further.

The two main drivers of the growth in the aircraft fleet itself are a growing middle class and their increased propensity to travel. According to Oxford Economics, the global middle class is expected to grow by 2.7% per year for the next 20 years, with the highest growth coming from Africa (4.6% p.a.) and Asia-Pacific (3.5% p.a.). Further, as a result of this middle class growth, many regions have a long runway to increase propensity to travel. For example, trips per capita in China are currently significantly lower than in the US (see chart below), and this is expected to grow 6.3% for the next 20 years (compared to 1.5% for the US).

To keep pace with air traffic growth, the global fleet will need to expand 4% per year, requiring $170-$210B of real financing per year (or $3.4 to $4.2T total). Specifically, the global fleet will take delivery of 40,000 aircraft over the next 20 years, mainly driven by new aircraft deliveries.

Asset Values

Aircraft values are very important in the aircraft leasing industry because they impact how lease rates are calculated. The supply of aircraft is mainly driven by OEM production (Boeing, Airbus, etc.). Over the past 60 years, aircraft production has become increasingly concentrated among the two major players (chart below), which is beneficial for aircraft prices as the OEMs have been disciplined in managing supply. Currently the major OEMs have record order backlogs from airlines, but have not noticeably increased production. Specifically, aircraft orders (as a % of the fleet) over the past decade have averaged about 10-14%, but OEMs have only increased deliveries (as a % of the fleet) from 5.7% to 6%.

Overall, asset values are supported by strong growth in air traffic and production discipline from the OEM oligopoly.

The Rise of Aircraft Leasing

In the 1970s, leased aircraft was around 0% of the global fleet. Driven by the various advantages to airlines, the leased aircraft base has grown to around 50% of the global fleet today. In the long-term, the leased aircraft as a percentage of the fleet has the potential to reach around 53%, based on empirical research and marginal returns for airlines.

Industry Attractiveness

Strategic Industry Analysis

Bargaining power of suppliers: high

Boeing and Airbus are a majority of the OEM production

Competitive intensity: medium

Strong growth in the sector

Fragmented industry and highly competitive market

Bargaining power of customers: low/medium

Most airlines have limited access to financing, meaning they are price takers

Also, the industry has a reasonable degree of concentration. The top three lessors control more than a quarter of the entire industry, and the top ten control 50% of the market

Barriers to entry: low/medium

There are high capital requirements

Industry knowledge, strong reputation, and airline relationships are necessary

Threat from substitutes: medium

Due to the many advantages of leasing, it will continue to be stable financing channel for airlines

Of course, the alternative to leasing is to raise financing through capital markets, banks, or just purchase the aircraft directly from the OEM

Leasing is the Most Viable Route for Airlines

Since 1970, airlines generated $14.6 trillion in revenues, but only $186 billion of profit (1.3% margin). These poor returns limit the ability of airlines to equity finance deliveries. Further, only 9 airlines (out of 380 commercial airlines) have an investment grade rating, meaning most airlines cannot issue debt themselves at attractive rates. Therefore, most airlines (even the profitable ones) lease a considerable portion of their fleet. However, there are also many other benefits to leasing aircraft for airlines.

Why do Airlines Lease Aircraft?

Airlines lease aircraft for the following reasons:

Don’t have to self-finance the aircraft. This is important because since most Airlines are not financially strong, they need to issue debt to purchase aircraft. By leasing aircraft, effectively “rent” the aircraft and avoid the large capital outlays. In turn, this helps the borrowing capacity and liquidity of the airlines.

Avoid residual value risk. By leasing the aircraft, the airlines don’t have to worry about disposing of the aircraft at the end of the lease.

Avoid obsolescence risk and have more fleet flexibility. Since aircraft are upgraded every few years by OEMs, airlines can always get access to the most efficient aircraft by using the leasing model. Further, leasing allows airlines to manage their fleet in a flexible way as they can negotiate terms such as type of aircraft, length of lease, type of lease, etc.

Flexible financing. Most aircraft is leased on an operating lease basis, meaning the financing is off-balance sheet and there are no restrictive debt covenants.

Airlines can focus on what they are good at.By offloading the asset management risk, airlines can focus on their strengths - building a brand, managing their efficiency, etc.

Industry Concentration

The aircraft leasing industry is moderately concentrated, with the top ten lessors controlling more than half of the market.

Industry Economics

Anatomy of an Aircraft Lease

Most aircraft have a useful life of 25 years. This is because after a certain point, it becomes uneconomical for airlines to continue owning the aircraft

Lease terms are usually between 8 and 12 years and 4-6 years for subsequent leases

Monthly rents are usually fixed

The airline is responsible for all day-to-day maintenance costs incurred during the lease period, but usually has to pay a regular fee to contribute to future maintenance events

Lease Rate Factor, Return on Equity, and IRR

The lease rates charged by lessors on an absolute dollar basis decline over the life of the aircraft, but the percentage rate increases because of the accelerated economic depreciation of aircraft (see Appendix). To further understand the industry economics, it’s important to understand how lease rates are set in the industry. The lease rate factor (LRF), which is the monthly “rent” charged by lessors divided by the total aircraft value, can be broken down into five main components:

Depreciation - the aircraft lessor requires compensation for the loss in economic value of the aircraft

Risk Free Rate - the lessor must price the credit component of the lease. To do so, the lessor can start with the risk free rate and add a spread to take into account the riskiness of the airline.

Airline Credit Spread - the lessor requires compensation for leasing to an airline, and based on the credit risk of the airline, the lessor adds an appropriate credit spread

Since airline lessors have better credit ratings than airlines, there’s an implicit premium built into this calculation. Since the risk free rate + airline credit spread will be higher than the risk free rate + airline lessor credit spread, this is the spread profit the lessor is capturing

Selling, General, and Admin Expenses (SG&A) - the lessor requires compensation for the costs that it incurs to lease aircraft (sales force expenses, other salaries, severance pay, advisory costs, office facility costs, travel costs)

Aircraft Lessor Cost of Equity - the lessor adds a return on equity component because it used some equity to finance the aircraft, and investors must be compensated for this

These factors, when put together, explain how lease rates are set in the industry. However, there are also other factors that impact the LRF:

Monthly Lease Rent (the numerator):

Economic Drivers: if the economy is in a downturn, there will be less demand for aircraft (and hence, aircraft leasing), which will push down lease rents (exhibit)

Aircraft Drivers: newer aircraft that are more cost-efficient and fuel efficient command a premium

Aircraft Value (the denominator):

Economic Drivers: if the economy is in a downturn, there will be less demand for aircraft, which will push down the price of aircraft in the market

Aircraft Drivers: newer generation aircraft are usually met with higher demand from airlines, which pushes up their price in the market

Age: older aircraft have lower market values (due to lower economic value after depreciation)

In the above example, a cost of equity (hurdle rate) for aircraft lessors was calculated based on average return on equity for the industry overtime. This will highly vary depending on the lessor, because each lessor has a different fleet portfolio (different depreciation), different risk profile (different loan-to-value), different strategy (different hurdle rate), and so on. Overall, the conclusion from this part of the exercise is that five main components help to explain a majority of the LRF. Now that we have broken down the LRF, it helps to understand how the economics flow to the aircraft lessor:

Clearly, the lessor’s leverage, cost of debt, aircraft depreciation, and tax rate are major factors that impact the ROE. The cost of debt assumed above is based on the industry average. Overall, the ROE for the lessor follows a fairly predictable pattern based on whether the lease is the first, second, or third lease for the aircraft, and this is mainly because newer aircraft have better demand and lower maintenance costs.

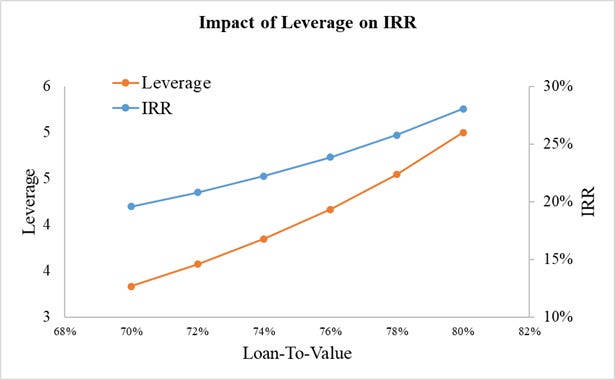

Lastly, it’s important to understand what the pre-tax cash IRR is on a lease-by-lease basis for aircraft lessors (see table below). This will be different from the accounting ROE because 1) it is pre-tax, 2) it doesn’t take into account depreciation on a year-by-year basis.

The above IRR analysis helps us appreciate the attractiveness of the aircraft leasing industry. On just a simple pre-tax cash-basis, lessors generate around 28% IRR on their lease deals. The major factor that drives this is leverage, as mentioned above. Lessors can take on a leverage (assets to equity) of 3x-5x (as seen in the industry as well), and still generate very attractive returns. The sensitivity chart below visualizes this:

Overall, the above analysis breaks down the unit economics for aircraft lessors and what the different drivers are. The key implications from this analysis can be summarized briefly below.

What Makes an Attractive Aircraft Lessor?

A portfolio of in-demand, new aircraft is ideal as it will yield high and stable lease rates

Secondly, in-demand, new aircraft will have more stable residual values through-cycle, which helps the aircraft lessor maintain their strong credit rating, thus allowing them to take market share during a downturn where lessors with weaker portfolios will encounter financial difficulties

Strong management team that has experience navigating various economic and credit cycles.

What does this mean? building the right portfolio (high residual values, high demand for aircraft), building a strong customer base, being rational through cycles of depressed lease rates, and knowing when to return capital to shareholders

Strong customer base

This helps the aircraft lessor maintain a strong credit rating because defaults result in re-marketing and re-placement of aircraft, which takes time and costs money, lowering the overall IRR of the lease

Has shown ability to access capital throughout the economic cycle, as debt is a key source of funding and returns for lessors

Has a good credit rating (investment grade) that has been stable overtime. Lower interest costs increase return on equity and IRR

Overall Industry Attractiveness

Overall, the aircraft leasing industry is modestly attractive because of the high potential cash IRRs that can be attained. However, there are many risks and things that have to “go right” for these IRRs to be achieved. Firstly, the management of the company must be strong, the business must have access to low-cost financing, and the company needs to have scale (to be able to place aircraft more easily across a larger customer base). The supplier power in the industry (Boeing/Airbus) is especially strong, and there are low barriers to entry besides capital. Further, the customer (airlines) have volatile financial stability in general which is another issue with the industry since the lessor needs to be able to re-possess the aircraft and lease it to another lessee frequently. The smaller aircraft lessors have more growth potential, but significantly higher bankruptcy risk. Lastly, leasing is nearing around 50% of all aircraft procured by airlines (has increased significantly over time), but this is expected to be the peak, meaning the overall industry may not grow as much going forward.

AerCap Business Analysis

Business Description

AerCap is currently the largest aircraft lessor in the world, with total assets of over $43 billion and a total lease fleet of $37 billion (12% market share). However, AerCap has gone through a major transformation over the past decade, which has cemented its place as the leader in the industry.

The Acquisition of ILFC

In 2013, AerCap was a smaller lessor, with an annual income of about $300 million and total lease assets of $8 billion. Management of AerCap then put together a deal to acquire ILFC, which had $24 billion in lease assets. There were a few main reasons why AerCap did this acquisition:

The combined aircraft portfolio and order book was very attractive, and AerCap believed it would generate high levels of sustained profitability for many years to come. Specifically, AerCap concluded that the combined portfolio would have the highest concentration of the most modern, fuel-efficient aircraft.

AerCap was able to negotiate a very attractive price to acquire ILFC. At the purchase price of $5 billion, the implied transaction value of the portfolio was $26 billion, which was about $6 billion below the fair value of the acquired portfolio. This would allow AerCap to sell undesirable parts of the portfolio (older aircraft) at prices higher than purchase price, generating a profit on aircraft divestitures.

Portfolio Transition

In 2014, AerCap had an overall fleet age of around 7.7 years and an average lease term of 5.7 years. Through the portfolio transition to get newer, in-demand aircraft, the overall fleet age has now reduced to 6.2 years and the lease term has increased to 7.5 years.

AerCap decided to construct an in-demand portfolio of aircraft, and today new technology (NT) aircraft make up 55% of AerCap’s portfolio. The company decided to do this because of three main reasons:

NT aircraft are usually more efficient, which is important for low cost carriers (LCCs) as fuel is a major cost for them (fuel as a % of total operating costs is around 20-25% for most airlines, but for LCCs is higher). Furthermore, LCCs are taking a larger share of the global fleet, making them ever more relevant (exhibit below).

Source for above chart.

Secondly, the improved economics of NT aircraft open up new routes for airlines. For example, since entering commercial service, the Boeing 787 has connected 235 point-to-point routes globally.

Lastly, more efficient aircraft drive the aircraft replacement cycle, which is important because ROEs for aircraft leasing are the highest in the first few years of the aircraft’s life.

Business Model/Strategy

The model is to issue debt at a low interest rate, fund an aircraft purchase with a certain % debt and a % equity, and lease that aircraft out at a higher rate (exhibit). The difference is profit attributable to equity holders.

AerCap described the key to success in the aircraft leasing business as: “Our ability to profitably manage aircraft throughout their lifecycle depends in part on our ability to successfully source acquisition opportunities of new and used aircraft at favorable terms, as well as secure long-term funding for such acquisitions, lease aircraft at profitable rates, minimize downtime between leases and associated technical expenses and opportunistically sell aircraft.”

Market Transactions

Part of the business model for aircraft lessors is to be able to buy and sell planes in the market with low lead times. This is important because after the lease is over for an aircraft, the lessor can choose to either lease it again or sell it in the market. AerCap has built a large group of sales professionals across the world and has built relationships with a variety of airlines to understand the demands of various parties, so that they can consistently sell aircraft quickly and at a good price. This is part of the business model because purchasing in-demand aircraft that will still have strong market values at residual is important in the lessor IRR equation.

Although the basic leasing model hasn’t changed for AerCap, the company’s business strategy has changed over the past few years.

Business Strategy/Portfolio Transition

Since the acquisition of ILFC in 2014, AerCap has gone through a strategic change to focus on younger, new-tech aircraft in the leasing portfolio. This is because having through-the-cycle, in-demand aircraft comes with a variety of benefits:

Better residual values for aircraft (boosts IRR)

Aircraft that are in-demand throughout the cycle have more stable residual values. This is because if the aircraft has secular demand, the probability of the residual value being what it was expected to be (aircraft value at beginning of period - expected depreciation) at the time of sale is higher. On the other hand, if the aircraft has weaker secular demand, in a downturn, the aircraft value will not hold up as well and therefore the lessor may be forced to sell it for lower. The residual value is important because it impacts the proceeds from aircraft sale and therefore the IRR of the lease

Better terms for borrowing, as lenders prefer a higher quality asset base, which reduces borrowing costs and pushes out repayment, increasing IRR

Reduces inherent standard deviation of the portfolio returns. This is because newer-generation, cost-efficient aircraft will always be in-demand due to the structure of the airline industry, which means during a recession it will be easier for the lessor to place and sell their aircraft

Higher utilization. Utilization measures how much time the aircraft is on-lease compared to its total life with AerCap. Higher demand aircraft have higher utilization, which minimizes the amount of time the aircraft is not making money for AerCap. The company has consistently had high 90%+ utilization, even during the 2008 crisis (exhibit).

Ecosystem Analysis

Competitor Analysis

It’s helpful to see the entire landscape of aircraft lessors and their individual business models. I selected a few of the larger leasing companies (not including the Chinese lessors) that operate globally.

The below chart displays selected data across four leasing companies:

A few takeaways:

A larger company size does not necessarily translate to a lower cost of debt

Each company has a different fleet strategy. AerCap and Air Lease are focused on younger, modern aircraft, while Air Castle and Fly Leasing have an older fleet.

From first glance, it looks as if all companies are fairly attractive considering their return on equity. However, AerCap and Air Lease are more attractive than the other firms because of their younger fleet focused on new generation aircraft (more fuel efficient) and narrowbody aircraft (more in demand than widebody). In a Davy Research Report on the industry, the authors noted:

“A poll conducted earlier this year by Airfinance Journal highlighted the relative proximity of the lease rates of new A320ceos versus new A320neos, and new B737-800s against new B737 MAXs. The appraisers polled suggested a range of lease rates for the new variants which were 6-13% higher than the old variants. While this may reflect the riskiness of taking delivery of early-production aircraft, with oil continuing to trade below $100, it may also imply that the operating economics of the new variants may not sufficiently exceed increased capital costs. This may also suggest that as interest rates rise, current generation aircraft may be competitively advantaged because capital costs are relatively more impactful for newer technology.”

This means that although the lessors who have an older, wide-body fleet are reaping the benefit of low interest rates and low fuel rates, throughout an economic cycle, newer technology aircraft will be in more demand by airlines as they are the most fuel efficient. This is especially important considering the low profit margins that airlines generally have.

Impact of COVID-19

The COVID-19 pandemic materially impacted airline traffic throughout the world. IATA, the International Air Transport Association, is a trade association of the world’s airlines (founded in 1945). The organization expects the airline sector will lose a total of $157 billion in 2020 and 2021, as shutdowns are expected to continue. Passenger miles are expected to drop to around 1.8 billion for 2020, down from a high of 4.5 billion in 2019. Overall passenger revenue is expected to drop almost 70% for airlines compared to 2019. In short, COVID was devastating for the airline sector.

Lessors have been a ray of hope for many airlines, who have been able to complete sale-leaseback deals with lessors, which has helped the airlines become more capital light during this difficult period. However, expectedly, lessors have also been hit hard. AerCap, the largest lessor, had its market capitalization cut by more than 35% (down from $8 billion to $5.2 billion currently). Air Lease’s stock price dropped by more than 50% after the initial shutdowns, and has only partly recovered. BOC, Asia’s largest aircraft lessor, stated in a news article that, “At the other end of the spectrum, we have the ‘have-nots’ where unfortunately, we have a number of governments around the world who have not stepped up to support our airline customers. This is a shame and we hope that changes – but at the moment, this is the case.” Effectively, there have been bankruptcies in the airline sector and there are expected to be many more as “without additional government financial relief, the median airline has just 8.5 months of cash remaining at current burn rates.”

Overtime, the airlines and lessors that were prepared to enter the downturn with strong balance sheets, low debt-to-equity, and financing capacity will be the ones that will come out on the other end. Eventually, airline traffic will go back to normal, but the question is how long will it take to recover and how deep will the shock be. According to IATA’s Chief Economist, the shock has been the largest since the post-war era. However, through wars and other difficulties, aircraft orders and pricing has remained resilient, as shown by the by the chart below:

Appendix

RPK stands for Revenue Passenger Kilometers is simply the number of kilometers travelled by paying passengers

DBS Equity Research

Davy Research Report: Aircraft Leasing, a World of Opportunity

https://www.sciencedirect.com/science/article/pii/S0965856416301963?via%3Dihub

https://www.flightglobal.com/strategy/airlines-split-into-haves-and-have-nots-boc-aviation-chief/140927.article

Source: CAPA - Centre for Aviation, OAG Schedules Analyser

AerCap Annual Report 2018

https://simpleflying.com/how-lessors-are-helping-airlines-weather-covid-19/

https://www.flightglobal.com/strategy/airlines-split-into-haves-and-have-nots-boc-aviation-chief/140927.article

https://www.bloomberg.com/news/articles/2020-11-01/these-are-the-airlines-teetering-on-the-brink-as-covid-drags-on

Davy Research Report: Aircraft Leasing, a World of Opportunity