A Needle in the Haystack

In my first article, I will dive into a company trading below excess net cash that is growing more than 20% a year, has a record backlog, and provides a significant dividend yield, all for 6x P/E

Investment Opportunity Snapshot

Company name: Oiltek International Limited

Market Cap: approximately $27.3mm

Since I started this article, the market cap has increased for some reason, there has been no new information

Revenue in 2023: $43.8m

Net income in 2023: $4.2m

Cash: $28.9m

Debt: 0

Company Overview

Oiltek is a Singapore-based company that provides engineering services for the edible and non-edible oil industry. They have three segments:

Edible and Non Edible Oil Refinery Segment: In this segment, Oiltek provides services such as:

Building new plants: Engineering, procurement of equipment, designing the process, construction, commissioning of the plants themselves

Improving existing plants: Upgrading and retrofitting plants of existing facilities

Turnkey OSBL infrastructure engineering: which is just basically a service that Oiltek provides which means they’ll handle everything besides building the main processing plant (water, electricity, storage)

Renewable Energy Segment: In this segment, Oiltek:

Building new plants: Designs and constructs new plants that produce biodiesel from different materials (like oils), biodiesel using enzymes (which is a cleaner method), special fuels for cold weather, and biogas from palm oil waste. They’ll take care of everything from the initial planning, engineering, to buying the materials, and making sure it works properly.

Improving existing plants: they help improve or expand current renewable energy plants.

Turnkey OSBL infrastructure engineering: similar services as in the previous segment. So this means they manage and build the support systems around the plant (handling waste, power, etc.).

The third segment is the Product Sales and Trading Segment:

This segment simply consists of engineering component sales

To summarize, Oiltek’s core competency is designing, building, and improving facilities that turn oils into useful “stuff”, whether it’s vegetable oils or other types of oils that can be turned into biodiesel. The company has been around for some time, being founded in 1980 and has since designed and commercialized over 650 plants in more than 34 countries. To be clear, the company does not run these plants, it is simply an engineering partner for companies who put the capital upfront to build these projects.

Market Opportunity

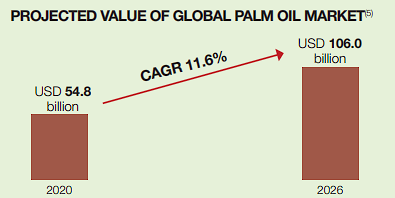

The main driver for the edible and non-edible oil refinery segment is population growth and improved standard of living. The global fats and oils market size is expected to be around $285 billion by 2026, representing a CAGR of 3.8% from 2021. Oiltek will benefit from this secular growth as it provides solutions that cater to many different types of vegetable oils such as palm oil, soybean oil, and rapeseed oil.

The main driver for the renewable energy segment will be the continued trend of environmental sustainability. For example, Indonesia, the world’s largest palm oil producer, continues to raise its mandatory blending of biodiesel from 30% to 35% and is expected to further raise it to 40% in the next few years. Blending biodiesel reduces reliance on traditional fossil fuels, lowering greenhouse gas emissions. Indonesia’s biodiesel consumption has reportedly reached 11.5m tons in 2023 due to the new rules that have been implemented, and will further grow with nationwide implementation. Another large palm oil producer, Malaysia, is also committed to implementing a biodiesel program to increase blending ratios from the currently mandated 20% and is targeting a 30% biodiesel blending for heavy land vehicles by 2030. The bottleneck for Malaysia is the readiness of biodiesel blending facilities, and that is where Oiltek’s engineering services can be valuable.

Another driver for the renewable energy segment is the aviation industry’s push towards sustainable aviation fuel (SAF). Singapore has plans to mandate SAF use for all departing flight starting in 2026, targeting an initial 1% SAF blend and aiming to increase it to 3-5% by 2030. Similarly, Malaysia seeks to establish a 1% SAF blending mandate and obtain SAF certification from international bodies, with a target of 47% by 2050. To produce this sustainable fuel, companies and governments will need to build plants, and Oiltek will be there as a partner. Oiltek already has solutions to use edible and non-edible oils to use as feedstock in the production of hydrogenated vegetable oil (HVO), which is used as an aviation fuel. In fact, the company has pioneered with a plant in Malaysia to field-test this service.

The third segment, which is the Product Sales and Trading segment, complements the other two segments as it provides replacement parts and maintenance services to customers.

Historical Performance

The company has been around since the 1980s, and thus the services it has provided have changed overtime. In its early days, it started using new methods to improve the quality of palm oil. Then in the late 1990s, the company got a large contract to build a plant to extract biodiesel from palm oil. Over the next decade, they got larger contracts and built competencies to make palm oil for various uses. Oiltek has continuously innovated over the last few decades, but its core competency lies in its ability to turn palm oil and other oils into useful stuff such as edible/non-edible oils or biodiesel. They “rent” out this skill as an “engineering service” to companies who actually spent capex to build the plants, and therefore are capital-light.

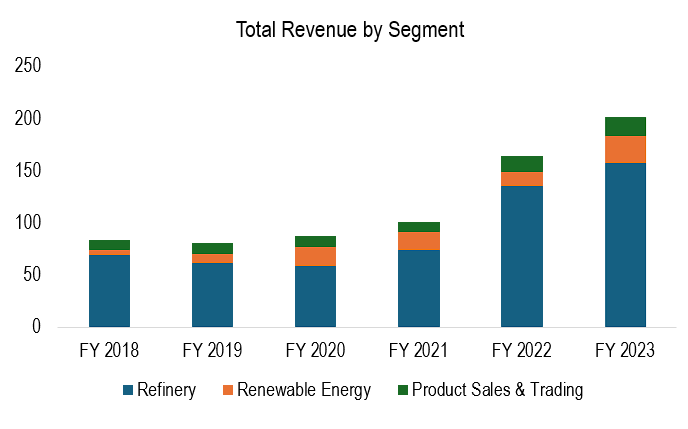

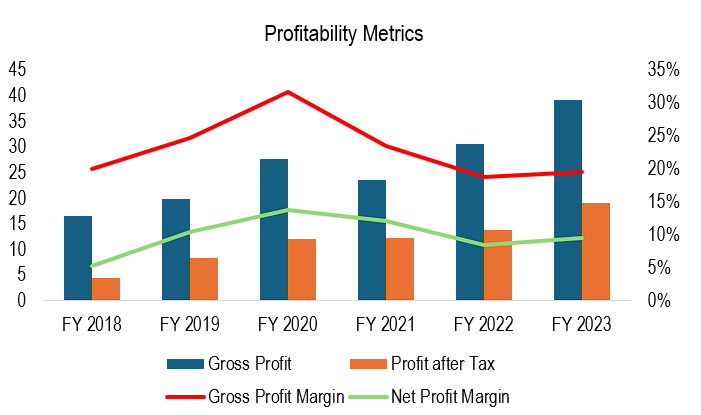

Below I have put together some charts to show the company’s financial metrics (we only have data going back to 2018). The data is in Malaysian Ringgit, which is the reporting currency:

The key questions I asked after looking through this data were:

What is driving the growth in the refinery segment?

The gross margin is volatile, what is driving this and what can we expect normalized GPM to be going forward?

Why did ROE go up so much over the last few years?

I believe these are the only two variables that will matter in the short to medium term for Oiltek.

Growth in the Refinery segment

The growth in the refinery segment is mainly driven by global population, which requires more refineries to be built for edible and non-edible oils. In 2023, Oiltek added Colombia and South Korea to its geographical coverage and seven new customers. Further growth in this category will be driven by geographical expansion. In 2019 revenue declined in this segment due to a decrease in revenue contribution from projects in Malaysia and Indonesia that are secured in prior years and performed substantially in 2018. Similarly, in 2020, revenue from this segment declined due to a decrease in revenue contribution from projects secured in Africa that substantially performed in 2019. Revenue in the segment since 2020 has erupted, growing from 59m RM to 157 RM in FY 2023. Therefore, a strong leading indicator for future performance will be the backlog, shown below, which continues to grow rapidly even as revenue grows across the organization.

The gross margin question

Why is gross margin lumpy? This lumpiness seems to be related to the fact that projects outside Indonesia and Malaysia have higher gross margins, as noted in the annual reports. Due to timing differences in revenue recognition, certain projects get recognized in different years, and thus consolidated gross margins will fluctuate in any given year. Further 2020 and 2021 were COVID years and the company had to deal with lockdowns and the IPO, therefore the company experienced some financial stress, leading to lower gross margins in 2021. Overall, normalized gross margins seem to be around 20% for the business, and normalized profit margins deviate around 10%.

The rise in return on equity

ROE went up from 10% to almost 30% in just a few years. Why? Profit growth does not explain all of the growth. Equity declined as well, which was mainly driven by contract assets going down and contract liabilities going up from 2018 to 2020. If we break the balance sheet down per year we can begin to see why ROE went up sharply and whether this is sustainable:

Firstly, I will define what these balance sheet items are from an accounting perspective:

Contract Assets: the company’s right to payment for work that is completed but not yet billed

Trade Receivables: amounts billed but not yet received in the form of payment (work is completed)

Contract Liabilities: represents obligations for services paid for but not yet delivered

Trade Payables: represents amounts owed to suppliers/vendors (working capital needs)

Essentially, from 2018 to 2020, ROE increased sharply because although profits tripled, equity declined due to less work being completed. Clearly, this didn’t represent a weakness in the business since it was collecting previously owed cash from customers and growing its backlog. Post IPO, the company has seen higher equity, meaning the company is completing work at a healthy rate while also booking future work (shown by rise in cash prepayments and higher contract liabilities). Therefore, ROEs of 20-30% are sustainable for Oiltek.

Management, Ownership, and Liquidity

Shareholders

The company is listed on the Singapore Exchange (SGX) but is 68% owned by Koh Brothers Eco Engineering Limited (KBEE). This is obviously a potential concern as it presents a conflict interest of public shareholders and KBEE. However, there is data that indicates that KBEE is not a “hands on” controlling shareholder and that Oiltek is reducing the influence that KBEE has on it.

The IPO: the IPO mathematically diluted KBEE’s stake, and therefore reduced the company’s influence on Oiltek

Credit Facilities: According to the prospectus: “All of the banking facilities granted by HSBC Malaysia are secured by corporate guarantees by our direct Controlling Shareholder, Koh Brothers Eco Engineering. We are in the process of procuring the release and discharge of Koh Brothers Eco Engineering under these corporate guarantees and obtain corporate guarantees from our Company instead […]”

Related-Party Transactions: Clearly, KBEE is a long-term partner to Oiltek. For example, KBEE adhered to the moratorium period imposed by Oiltek after the listing and even after that period did not sell any shares in the public market. However, risks remain, one of which is related party transactions. For example, in the past, Oiltek has made payments on behalf of KBEE. It’s not entirely clear what these payments or fees were for, and KBEE owed Oiltek 5.7m RM ($1.1m USD) for these transactions as of 2021. However, Oiltek mentioned in the prospectus that all amounts have been repaid by KBEE, and the company “does not intend to enter into such arrangements with the KBE Group after the Listing.”

Reorganization: as noted in the prospectus: “Koh Brothers Eco Engineering, our direct Controlling Shareholder, and its subsidiaries (excluding our Group) (the “KBE Group”) are principally engaged in the provision of engineering, procurement and construction services, specialising in providing building and civil engineering construction, infrastructure works, water and wastewater treatment as well as hydroengineering projects. Due to legacy acquisition reasons, certain subsidiaries of Koh Brothers Eco Engineering used to be in the same business as our Group but have since become dormant companies with no business operations.”

Non-Compete: Oiltek and KBEE signed a fairly comprehensive non-compete agreement, as outlined in the prospectus: “Notwithstanding that the existing engineering, procurement and construction services provided by KBE Group are distinct business offerings from ours, in order to address and/or mitigate any potential conflicts of interests that may arise, Koh Brothers Eco Engineering has provided a non-compete undertaking on the following terms which shall commence on the Listing Date and terminate on the earlier of the date falling on which Koh Brothers Eco Engineering ceases to, directly or indirectly, be our Controlling Shareholder or the date falling on which we cease to be listed on the SGX-ST (the “Non-Compete Period”), Koh Brothers Eco Engineering (a) shall not; (b) shall procure its subsidiaries not to; and (c) shall use its best endeavours to procure its associated companies not to, whether directly or indirectly, through or on behalf of any natural person, corporation or entity, engage in, carry on (whether alone or in partnership or joint venture with anyone else) or otherwise be interested in (whether as trustee, principal, agent, shareholder, unitholder or in any other capacity) any business in Singapore, Malaysia or elsewhere which is directly or indirectly in competition with or similar to the business of our Group (the “Oiltek Business”) for the duration of the Non-Compete Period. Such non-compete undertaking shall not apply to any interest(s) in any companies in our Group; and any interest(s) in quoted or listed securities which do not exceed 5.0% of the total amount of issued securities in that class. Oiltek has provided a similar non-compete undertaking in relation to the business of Koh Brothers Eco Engineering.” Basically for as long as Oiltek is a public company, KBEE won’t compete with Oiltek’s businesses and Oiltek won’t compete with KBEE. The issue is that this may limit Oiltek’s business scope, but since the company is trading at a cheap valuation and still has a long runway in its core markets, this is not an issue at the moment, but could be down the road.

Overall, Oiltek has made material efforts to reduce the influence of KBEE on its business, and although this will not completely transpire until KBEE’s stake is further reduced, the partnership has been helpful for Oiltek for many years and I don’t see this changing any time soon. It seems Oiltek is aligning its interests with public shareholders more and more since being a publicly traded company, targeting a 40% payout ratio and returning capital through mainly dividends.

Liquidity

The company is listed on Catalist, a platform on the SGX that is primarily for fast growing, emerging and/or smaller companies. These companies tend to be less liquid compared to companies listed on the main board. Volume can fluctuate for this company, with some days having no trading volume and other days experiencing up to 400,000 shares in volume.

Valuation

With a market cap of $27.3m at time of writing, the company is comfortably trading below the cash on its balance sheet. Most of this cash built up in 2023, when contract assets decreased (indicating that previously recognized revenue was billed and collected) and contract liabilities increased (the company received more prepayments from customers). As the company noted in it’s prospectus:

The company’s model of solely providing engineering services and covering working capital needs with operating cash flow indicates that whatever cash is built up on the balance sheet can be therefore used to pay shareholders in the form of dividends or buybacks. The company has been targeting a 40% payout ratio and has achieved this in recent years since going public, and at today’s valuation is about an 8% dividend yield.

From an earnings perspective, the company has a 361m RM order backlog, which the company intends to fulfill over the next two years. Assuming no new orders, not counting the orders that have been paid for but not fulfilled, and not subtracting cash, that equates to about a 7.2x P/E ratio (assuming a normalized profit margin of 10%, as shown above).